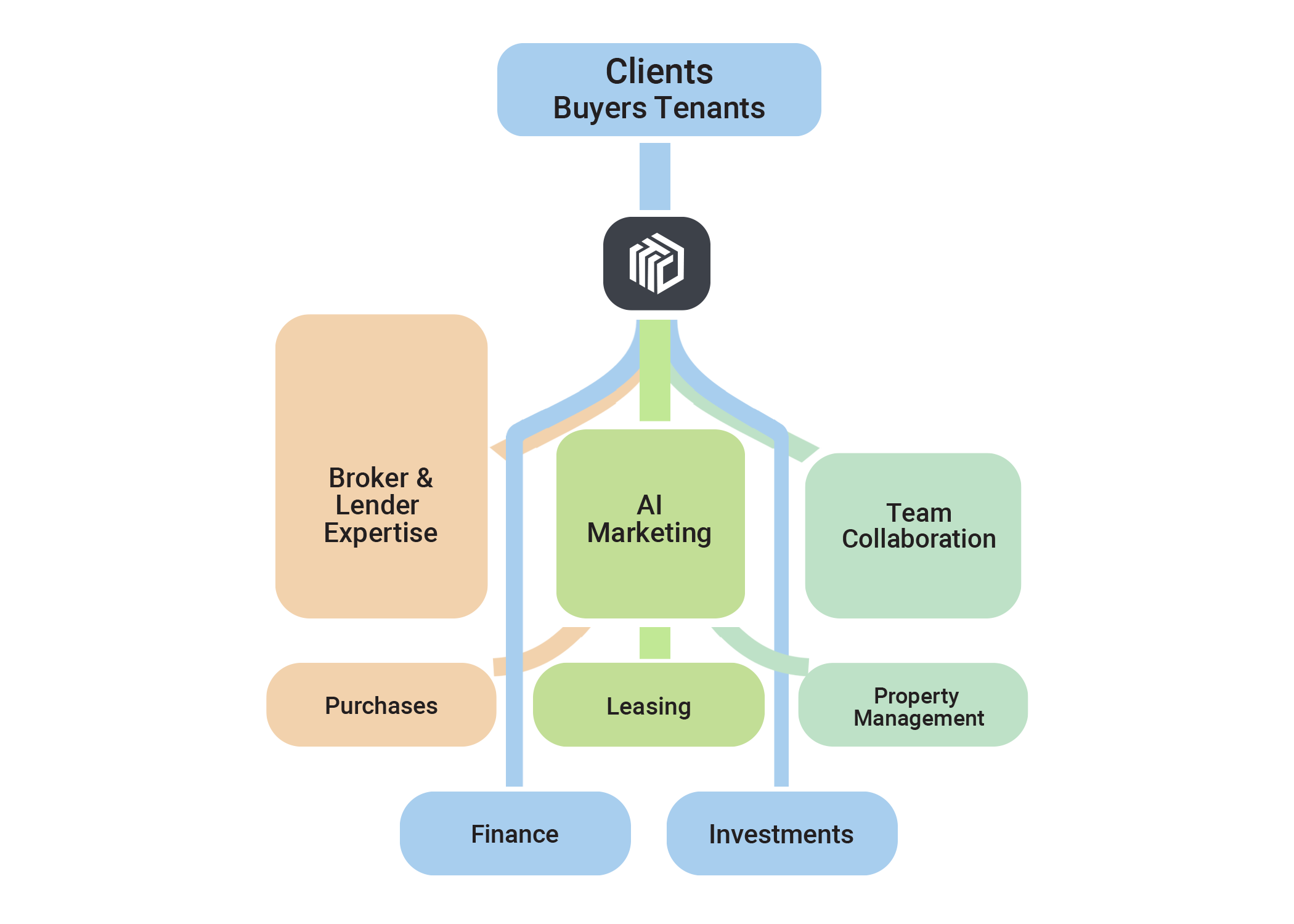

Tech-Driven. Broker-Led

We Do Purchases

We Do Leasing

We Do Property Management

We Do Investments and Finance

We Are Tech-Driven, Broker-Led.

We Are TechDriven CRE Experts.

We Do Purchases

We Do Leasing

We Do Property Management

We Do Investments and Finance

In today’s fast-evolving commercial real estate (CRE)

landscape, technology is no longer a supporting tool—it’s a

strategic driver.

From AI-powered market analytics to smart building

automation, tech innovation is transforming how investors,

brokers, and tenants make decisions.

At Lee & Associates, we embrace this evolution by

integrating powerful digital platforms that enhance

deal-making, streamline operations, and deliver sharper

insights across the CRE lifecycle.

Smart, supportive Experts dedicated to you, your properties, and your finance goals.

Landlord Representation

We work with you to uncover opportunities that increase your property’s value — from raising income, decreasing expenses, and improving performance to addressing weaknesses that impact rental income — while helping you secure quality long term tenants and providing clear, straightforward opinions of value.

Purchases

Not sure if you should buy or lease? Our team of commercial real estate experts will walk you through the options, explain financing choices, and help you make the decision that’s best for your future. If you’re buying a building for your business, you may be able to purchase with as little as 10% down — and in some cases, 100% financing is available.

Investment Sales

We work with you through the purchase and sale of your properties — analyzing the underlying real estate to maximize value, weighing single-tenant versus multi-tenant opportunities, and managing 1031 exchanges with the same care and precision you would expect from a true partner.

Tenant Representations

Relocating your business can be stressful, but we make it easier. We partner with you every step, providing honest advice, caring support, and hands-on guidance — because we care about you and your business as much as you do.

Property Management

Owning property should be rewarding, not stressful. We take on the heavy lifting so you can enjoy the benefits without the headaches.

CRE Financing

Having gone through the financing process ourselves, both personally and alongside other investors and owners, we know the challenges firsthand. We’re here to take the stress off your plate, provide trusted options, and work with you to achieve your goals.

Never stress again

From start to finish, we handle the details --giving you the freedom to focus on what matters

Meet the Experts

Tech-powered brokers and trusted real estate professionals who simplify complex decisions and turn them into clear, actionable strategies for your success.

Stuff you’re probably wondering

(that we can definitely help with)

How do I get my tenant to pay rent

How do I get the highest price for my building (increase value)

What type of financing is available for CRE properties.

Who is responsible for repairs on a property

How do leases work in commercial real estate?

How is commercial property valued?

What is a cap rate, and why is it important?

How do investors make money in commercial real estate?

Frequently Asked Questions

How do I get my tenant to pay rent?

If a tenant falls behind on rent, we can work with you to address the situation professionally. While we don’t provide legal advice, we use our experience in lease enforcement and tenant relations to help you communicate effectively, reduce stress, and protect your income.

How do I get the highest price for my building (increase value)?

We work with you to uncover opportunities that boost your property’s value. This may include raising income, reducing expenses, strengthening tenant quality, and positioning your building strategically in the market. Our goal is to help you achieve the strongest price possible.

What type of financing is available for CRE properties?

There are several financing options available — including traditional bank loans, SBA loans, bridge loans, CMBS loans, and private lending. We’ve secured financing for our own properties and for clients like you, so we know how to simplify the process and bring you the right solutions for your needs.

Who is responsible for repairs on a property?

That depends on the type of lease in place. In some leases, you as the owner cover repairs; in others, the tenant may be responsible. We don’t give legal advice, but we can draw on years of experience to help you structure leases and set expectations that protect your investment.

How do leases work in commercial real estate?

Leases outline the rent, responsibilities, and use of your property. They can be structured in different ways — gross, modified gross, or triple-net. While we don’t provide legal consultation, we help you understand how these structures work and guide you in negotiating terms that fit your goals.

How is commercial property valued?

Your property’s value is based on factors like income, expenses, occupancy, location, and market trends. We work with you to provide clear, professional opinions of value so you can make informed decisions.

What is a cap rate, and why is it important?

A cap rate measures your expected return based on the property’s income and price. It’s one of the most important tools investors use to evaluate opportunities. We can help you understand how cap rates apply to your property and how they affect value.

How do investors make money in commercial real estate?

Investors typically earn through rental income, property appreciation, and tax advantages. With the right management, financing, and strategy, you can maximize returns. We share our knowledge and experience to help you make smart investment choices.

Why should I use a broker for landlord or tenant representation?

When you work with us, you gain access to our market knowledge, negotiation skills, and broad network of tenants, landlords, and investors. We partner with you to reduce vacancies, secure favorable lease terms, and get the best value out of every deal.

What does property management include?

With property management, we take the stress off your plate by handling tenant relations, rent collection, lease enforcement, and day-to-day issues. We treat your property as if it were our own, so you can enjoy ownership without the hassle.

How does a 1031 exchange work?

A 1031 exchange allows you to defer capital gains taxes by reinvesting proceeds from one property sale into another. While we don’t provide legal or tax advice, we’ve helped many owners like you successfully complete exchanges, and we can connect you with the right professionals and guide you through the process.

How do I know if a property is a good investment?

We work with you to analyze income potential, expenses, location, tenant stability, and market trends. Based on our years of experience, we help you evaluate whether a property fits your goals and give you the insights you need to invest with confidence.